main street small business tax credit 1

Californias government decided to take action to supplement federal relief through the Main Street Small Business Tax Credit. The Main Street Small Business Tax Credit II provides Covid-19 financial relief to qualified small businesses.

Small Business Tax Credits The Complete Guide Nerdwallet

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

. The smartest path to extending your runway. On November 1 2021 California will begin accepting applications. The main street small business tax credit ii may be used to offset income tax or sales tax by making an irrevocable election.

50 AB-50 established the California Main Street Small Business Tax Credit II which will provide COVID-19 financial relief to qualified small business employers. The small business hiring tax credit provides a credit that a small business employer can use to offset their income taxes or their sales and use taxes when filing their tax returns. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

Plug your accounting and payroll systems into the MainStreet dashboard to give us some insight into your RD activities. MainStreet is on a mission to help every small business make a big impact. The Main Street Small Business Tax Credit is for employers affected by the economic disturbances of 2020.

Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. What is the Main Street Small Business Tax Credit. Your Main Street Small Business Tax Credit will be available on April 1 2021.

The 2021 main street small. This bill provides financial relief to qualified small businesses for the economic. If your business is eligible for the tax credit you will receive 1000 per net employee hired during July 1 2020 through November 30 2020.

For an employer to qualify for the credit the qualified small. We take the guesswork out of tax credits and pass the untapped. We scan hundreds of federal state.

Taxpayers must make a credit reservation in order to claim the credit. The amount of credit available for the California Main Street Small Business Tax Credit program was capped at 100000000. On November 1 2021 the California Department of Tax and Fee.

Qualified small businesses will be able to use the credit to offset their 2021 California income taxes or their 2022 sales and use tax deposits. However You must claim this credit on a timely filed original tax. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers. This bill provides financial relief to qualified small businesses for the economic. The Main Street Small Business Tax Credit is a relief fund for Californias small businesses to help them get back on their feet and heal the economy.

Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. California Assembly Bill No. To qualify for the credit a California employer.

In order to determine the net. Beginning on November 1 2021 and ending November 30.

Small Business Tax Credits The Complete Guide Nerdwallet

California Main Street Small Business Tax Credit Ii Krost

Rosin Preservation Rosinpreserves Twitter

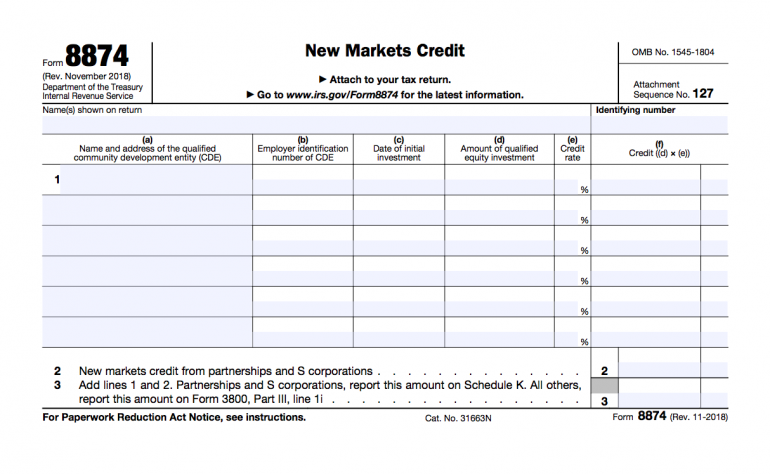

New Markets Tax Credit Investments In Our Nation S Communities

California Main Street Small Business Tax Credit

Main Street Small Business Tax Credit Incentives Eligibility

California Main Street Small Business Tax Credit Ii First Come First Served By November 30 Marcum Llp Accountants And Advisors

California Main Street Small Business Credit Ii Kbkg

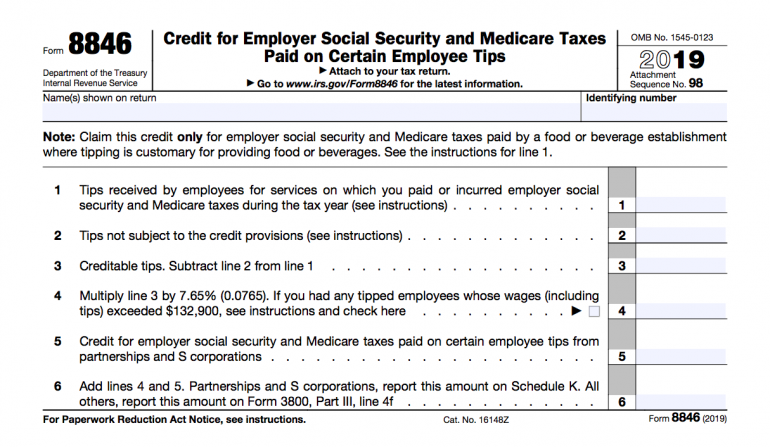

The Big List Of U S Small Business Tax Credits Bench Accounting

California Establishes Main Street Small Business Tax Credit Taxconnections

Small Business Tax Credits The Complete Guide Nerdwallet

Covid 19 Small Business Committee

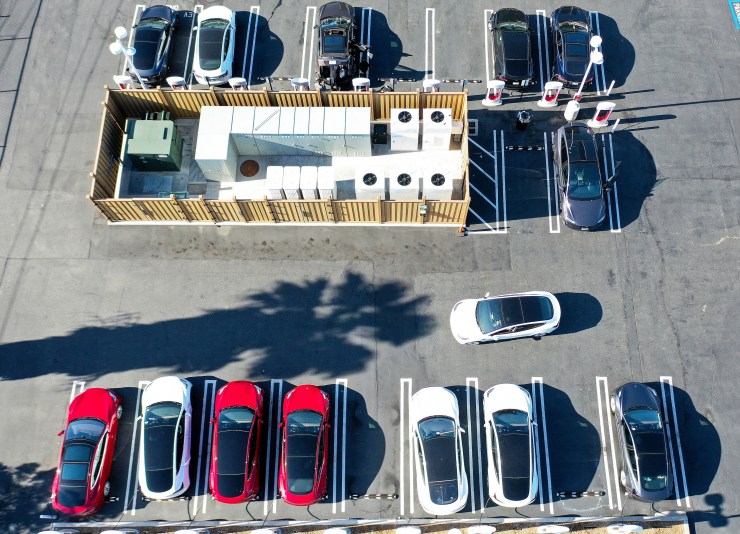

New Senate Climate Bill Contains Ev Tax Incentives Marketplace

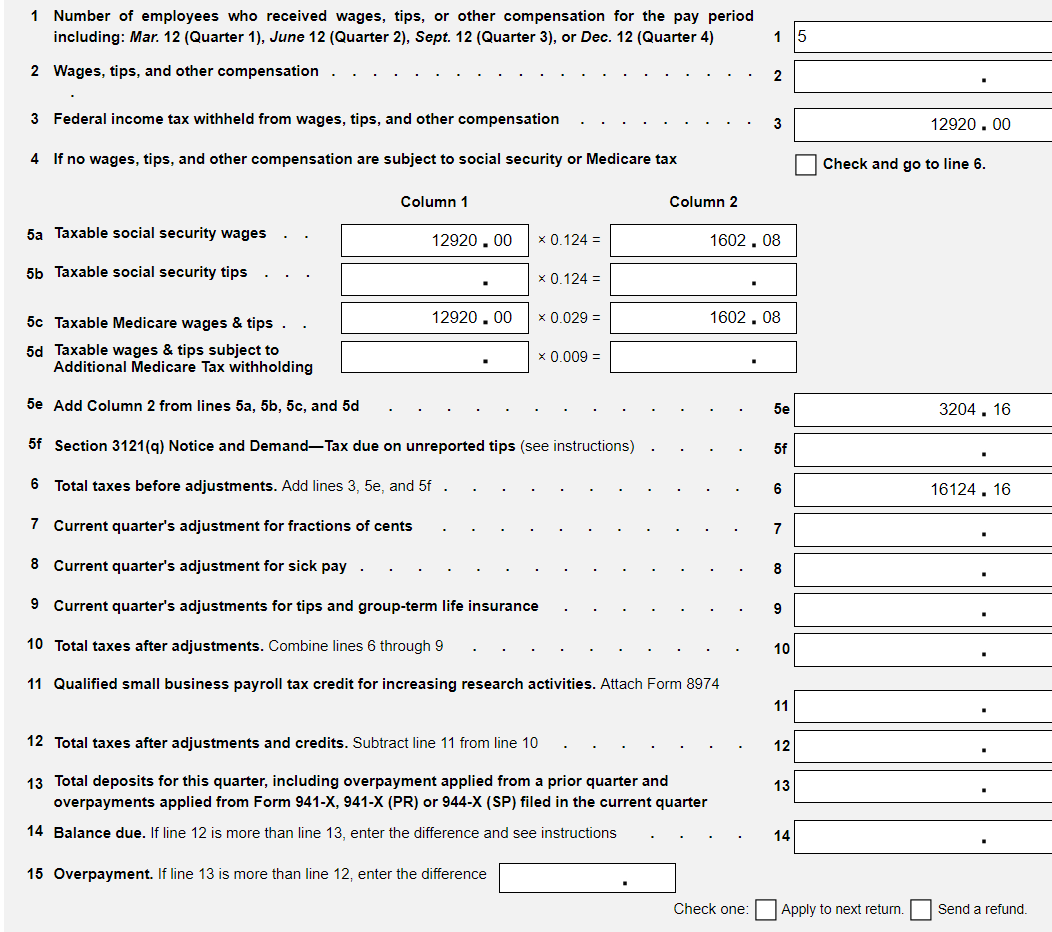

Solved Complete Form 941 For The 2nd Quarter Of 2019 For Chegg Com

Senator Shannon Grove On Twitter Earlier This Year I Supported Sb1447 To Bring Much Needed Help To Our Small Businesses Are You A Small Business Owner Check Out The Fact Sheet Below